Shari'a-Compliant Financing for Real Estate

26 March 2024

Fairway currently provides two Shari'a-compliant lending solutions to numerous clients. Partnering with highly regarded onshore and offshore law firms, with dedicated Islamic finance specialists, we offer a collaborative approach throughout a structure’s lifecycle.

Requirement

Fairway were approached by a prominent family based in the GCC who required Shari'a-compliant financing for real estate investment purposes.

Solution

With a strong affinity to the Middle East, Fairway has gained extensive knowledge and experience having worked with clients and intermediaries throughout the GCC for many years.

With particular expertise in Shari'a-compliant structures, Fairway provides two options to support our clients’ requirements for borrowing, both of which are Shari'a scholar approved and endorsed by Fairway’s corporate teams and clients.

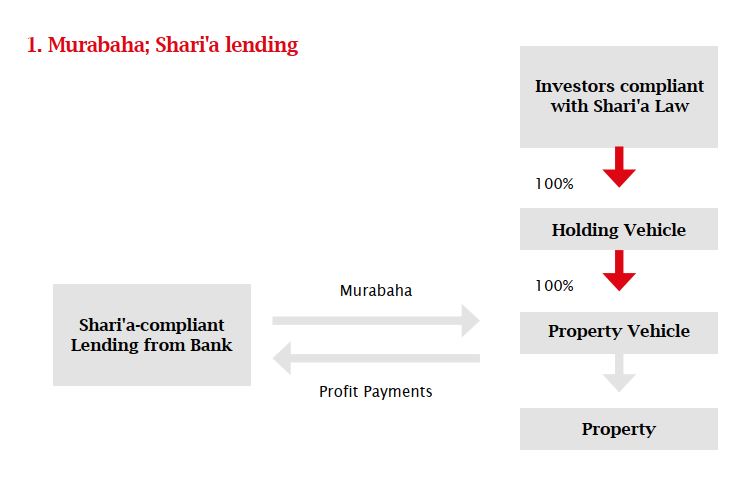

Shari'a-compliant lending (see structure 1 below):

A property owning company (“propco”) enters into a lending arrangement with a Shari'a-compliant bank. The bank will create a Commodity Murabaha (trading of commodities in a trilateral agreement between the bank, propco and the original commodity holder). The funds that are used are automatically Shari'a-compliant once the commodity trade completes. Investors can invest directly into the holding vehicle (“holdco”), which wholly owns the propco and will receive returns that filter up from the propco via a distribution.

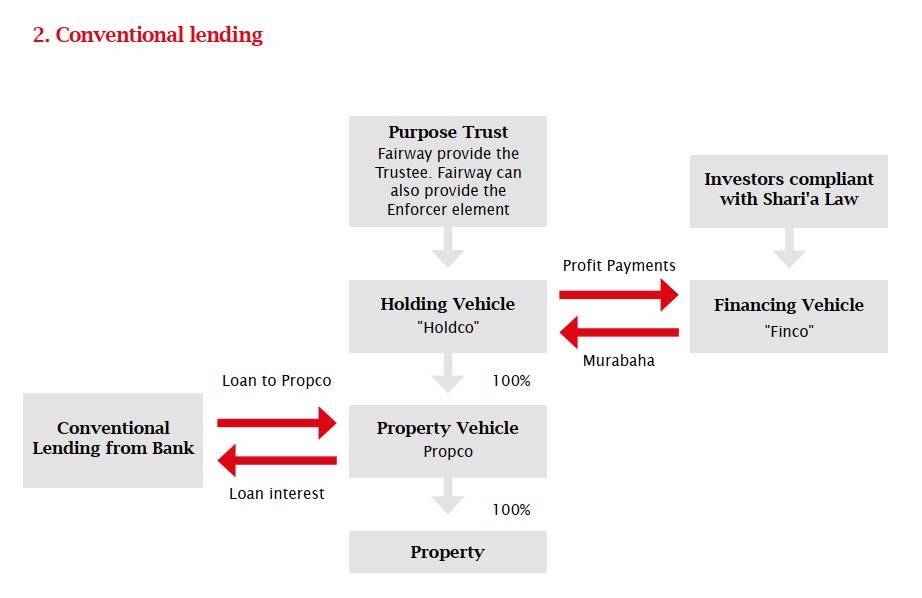

Conventional lending (see structure 2 below):

Similar to case study 1, there is a propco and a holdco, although in this scenario the propco is borrowing from a non-Shari'a-compliant lender and holdco is wholly owned by a Purpose Trust. The investors will invest into a financing company (“finco”) that enters into a trilateral Commodity Murabaha agreement with the holdco and the initial commodity holder. Once the commodity trade ensues, the funds returned to the finco via Murabaha profit are now Shari'a-compliant.

Results

Fairway currently provides both Shari'a-compliant lending solutions to numerous clients who successfully utilise the structure for multiple real estate transactions. They partner with highly regarded onshore and offshore law firms, with dedicated Islamic finance specialists to offer a collaborative approach throughout a structure’s lifecycle.

BACK TO NEWS

BACK TO NEWS